May 29, 2015

Toronto, Ontario, May 29, 2015 – Changfeng Energy Inc., (TSXV: CFY) (“Changfeng” or the “Company”), is pleased to announce that the Company has filed its unaudited condensed interim consolidated financial results for the first quarter ended March 31, 2015. The unaudited condensed interim consolidated financial results and Management Discussion and Analysis can be downloaded from www.SEDAR.com or from the Company's website at www.cfenergy.com

Note:

(1) See Non- IFRS Financial Measures in this Press Release

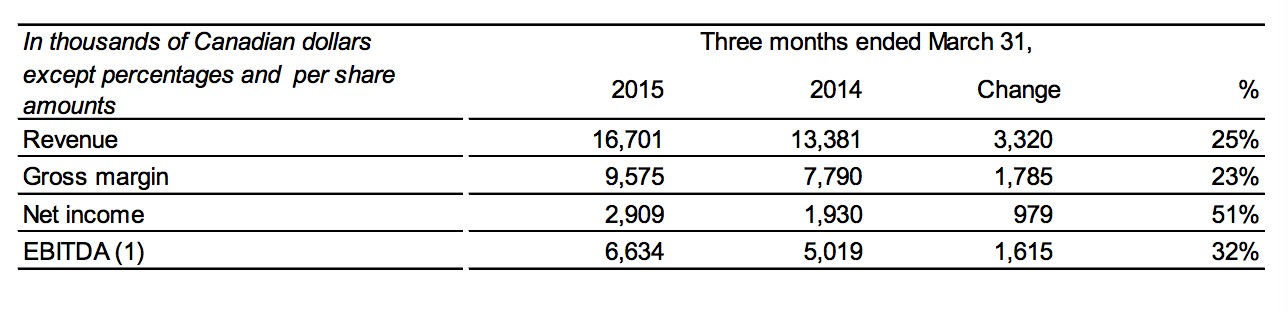

Revenue for the three months ended March 31, 2015 was $16.7 million, an increase of $3.3 million, or 25%, from $13.4 million for the same period of 2014. This increase is mainly attributable to continued gas sales volume growth resulting from a growing customer base, higher average selling price for gas from its CNG refueling retail station in Changsha City, higher pipeline connection revenue, and appreciation of the exchange rate between the Chinese RMB and the Canadian dollar.

Revenue from gas sales for the three months ended March 31, 2015 was $8.6 million, an increase of $1.4 million or 20%, from 7.2 million for the same period of 2014. The increase is mainly attributable to:

- gas sales volume growth of 10% in Sanya region;

- gas sales volume growth of 10% in Xiangdong district; and

- the appreciation of the exchange rate between the Chinese RMB and the Canadian dollar

Pipeline installation and connection revenue for the three months ended March 31, 2015 was $5.9 million, a significant increase of $1.7 million or 40%, from $4.2 million for the same period of 2014. The increase is mainly attributable to:

- an increased number of new residential customers connected during the period in Sanya region, which totaled 5,860, an increase of 3,829 or 189%, from 2,031 for the same period of 2014;

- an increased number of new commercial customers connected during the period in Sanya region, which totaled 22, an increase of 15 or 214%, from 7 for the same period of 2014, moreover, some of them are in high contract amounts;

- an increased number of new residential customers connected in Xiangdong district during the three months ended March 31, 2015 totaled 1,209, an increase of 875 or 262%, from 334 for the same period of 2014.

- two commercial customers connected during the period in Xiangdong district with compared to nil for the same period of 2014

- the appreciation of the exchange rate between the Chinese RMB and the Canadian dollar

Total revenue from the CNG refueling retail station for the three months ended March 31, 2015 was $2.2 million, an increase of $0.2 million, or 9%, from $2.0 million for the same period of 2014. The increase was totally attributable to Chinese RMB appreciation and revenue in RMB was reduced by RMB 0.2 million or 1%. CNG sales volume dropped during the three months ended March 31, 2015 by 7% compared to the same period of 2014, though the average selling price was higher due to the price increase announced in the third quarter of 2014 by the local pricing authority.

Gross margin for the three months ended March 31, 2015 was $9.6 million, an increase of $1.8 million, or 23%, from $7.8 million for the same period of 2014. The gross margin percentage of 57% for the three months ended March 31, 2015 was slightly decreased from that of 58% for the same period of 2014.

Natural gas distribution utility gross margin as a percentage of sales year-over-year dropped by 2% (63% for the three months ended March 31, 2015 VS 65% for the same period of 2014). The CNG refueling station gross margin as a percentage of sales year-over-year increased by 3% (21% for the three months ended March 31, 2015 VS 18% for the same period of 2014) primarily attributable to the higher average selling price derived from the CNG sales price increase announced on August 29, 2014 by the local gas pricing authority.

General and administrative expenses for the three months ended March 31, 2015 were $3.1 million, an increase of $0.4 million, or 14%, from $2.7 million for the same period of 2014. The increase is in correspondence with the sales growth and partly from the Chinese RMB appreciation. Due to more stringent and efficient cost management, general and administrative expenses as a percentage of sales for the three months ended March 31, 2015 were 19%, lower than 21% for the same period of 2014.

Travel and business development expenses for the three months ended March 31, 2015 were $0.9 million, a decrease of $0.2 million, or 16%, from $1.1 million for the same period of 2014 under more stringent and efficient cost management. As a percentage of sales, travel and business development expenses for the three months ended March 31, 2015 were 5.4%, a decrease from 8% for the same period of 2014.

Net income for the three months ended March 31, 2015 was $2.9 million, or $0.04 per share (basic and diluted) compared to $1.9 million or $0.03 per share (basic and diluted) for the same period of 2014.

EBITDA (non-IFRS financial measure as identified and defined under section “Non-IFRS Measures”) for the three months ended March 31, 2015 was $6.6 million, an increase of $1.6 million, or 32%, from $5.0 million for the same period of 2014. The increase was driven primarily by higher sales and connection revenue. EBITDA as a percentage of revenue for the three months ended March 31, 2015 was 40%, a slight increase from 38% as for the same period of 2014.

Net cash provided by operations was $5.8 million for the three months ended March 31, 2015 compared to $2.1 million for the same period of 2014.

Cash used in financing activities during the three months ended March 31, 2015 primarily included a $0.1 million long term loan repayment.

Cash used in investing activity included capital expenditures of $3.4 million for the three months ended March 31, 2015 compared to $1.9 million for the same period of 2014. The expenditures were mainly related to the purchase of equipment and new office building construction for the Xiangdong project, and the on-going construction of pipeline networks to connect new customers in the Sanya region and Xiangdong district.

Changfeng will finance the majority of the upcoming construction of projects under development in mainland China through its long-term bank loans with the BOC and BOC, Pingxiang, as well as operating cash flow from its existing operations.

Non-IFRS Financial Measures

The Company uses the following non-IFRS financial measure: EBITDA. The Company believes this non-IFRS financial measure provides useful information to both management and investors in measuring the financial performance and financial condition of the Company for the reasons outlined below.

Management uses this non-IFRS financial measure to exclude the impact of certain expenses and income that must be recognized under IFRS when analyzing consolidated operating performance, as the excluded items are not necessarily reflective of the Company's underlying operating performance and make comparisons of underlying financial performance between periods difficult. From time to time, the Company may exclude additional items if it believes doing so would result in a more effective analysis of underlying operating performance. The exclusion of certain items does not imply that they are non-recurring.

This measure does not have a standardized meaning prescribed by IFRS and therefore they may not be comparable to similarly titled measures presented by other publicly traded companies and should not be construed as an alternative to other financial measures determined in accordance with IFRS. This measure is listed and defined below:

EBITDA

EBITDA is defined herein as income before income tax expense, interest expense, depreciation and amortization, share of loss of investment in associate, as well as non-cash stock-based compensation expense. EBITDA does not have any standardized meaning prescribed by IFRS and therefore may not conform to the definition used by other companies. A reconciliation of net income to EBITDA for each of the periods presented as follows:

|

In thousands (except for % figures) |

Three months ended March 31, |

|||

|

2015 |

2014 |

Change |

Change % |

|

|

Net Income |

2,909 |

1,930 |

979 |

51% |

|

Add (less): |

||||

|

Income tax |

2,142 |

1,469 |

673 |

46% |

|

Interest (income) expense |

(33) |

(9) |

(24) |

271% |

|

Share of loss of investment in associate |

0 |

8 |

(8) |

-100% |

|

Stock-based compensation |

29 |

87 |

(58) |

-67% |

|

Amortization |

1,070 |

1,044 |

26 |

3% |

|

Interest on borrowing |

516 |

490 |

26 |

5% |

|

EBITDA |

6,634 |

5,019 |

1,615 |

32% |

Changfeng Energy Inc. is a natural gas service provider with operations located throughout the People's Republic of China. The Company services industrial, commercial and residential customers, providing them with natural gas for heating purposes and fuel for transportation. The Company has developed a significant natural gas pipeline network as well as urban gas delivery networks, stations, substations and gas pressure regulating stations in Sanya City & Haitang Bay. Through its network of pipelines, the Company provides safe and reliable delivery of natural gas to both homes and businesses. The Company is headquartered in Toronto, Ontario and its shares trade on the Toronto Venture Exchange under the trading symbol “CFY”. For more information, please visit the Company website at www.cfenergy.com

For further information please contact:

|

Mr. Yan Zhao CPA. CA |

Ms. Ann S.Y.Lin |

|

Chief Financial Officer |

VP, Corporate Development and Corporate Secretary |

|

416.362.5032/647.528.0115 |

416.362.5032 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

- End -

(647) 313-0066

(647)313-0088

cfny@changfengenergy.cn

Unit 308, 3100 Steeles Ave E, Markham, ON, Canada, L3R8T3